Buy & Sell on Tanzania's #1 classifieds

Discover our categories

- 177314Vehicles

- 54648Smartphones

- 127978Multimedia

- 7687Men’s Fashion

- 5431Women’s Fashion

- 49722For the home

- 4713Health & Beauty

- 2321Kids

- 8855Hobby & Sports

- 25729Everything else

- 8758Jobs

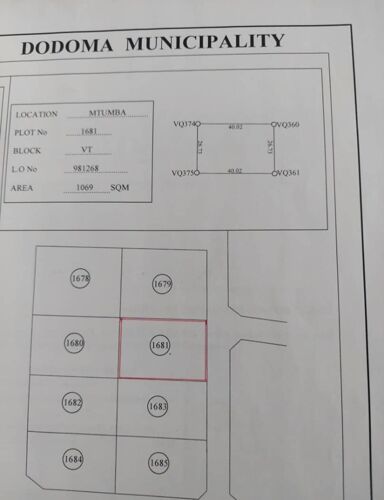

- 69876Real estate

Recent Ads

Download for free

For a better user experience and access to more features download our new apps